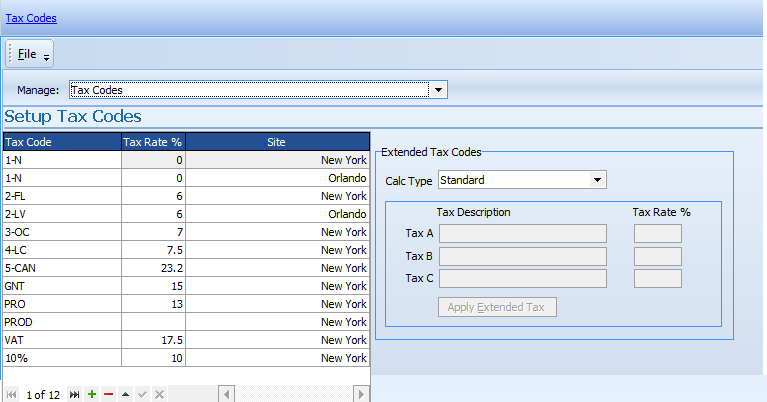

Tax is a simple reality of your business and HireTrack NX includes the ability to calculate both simple and complex Tax Codes. In some regions a Compound Tax may be needed to calculate Cumulative or Additive taxes.

button:![]()

Click the starred line

Enter the tax code and then tab and enter the tax rate. Multi-site users will select the site for the tax to be used.

button:![]()

If you need to delete a Tax, press the - button and the program will first check to see if the Tax Code is in use. If it is not used, the Tax Code may be deleted.

What is an Extended Tax Code?

Extended Tax Codes refer to when one Tax Code represents more than one tax. An example would be: Tax Code of T1 may represent the State plus City Tax or a Provincial Tax + a Federal Tax.

Several calculation methods are available for this. An Additive Tax, A Cumulative Tax and a combination (Additive/Cumulative Tax).

Perhaps you have three taxes... TAX A is 10%, TAX B is 20% and TAX C is 40%.

The calculation method can be one of the following:-

Additive [A+B+C]%. In this case all the 3 Tax Rates are added together and that is then applied to the Invoice

Example: $100 purchase

$100 x 10% =$10.00 for a total of $110.00

$100 x 20% =$20.00 for a total of $130.00

$100 x 40% =$40.00 for a total of $170.00

therefore the total Tax will be $70

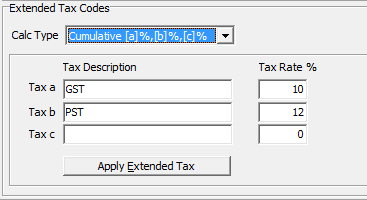

Cumulative [a]%,[b]%,[c]%. In this case each Tax will be applied individually in turn on the total including Tax.

Example: $100 purchase

$100 x 10% =$10 for a total of $110.00

$110 x 20% =$22 for a total of $132.00

$132 x 40% =$52.80 for a total of $184.80

therefore the total Tax is $84.80.

AddCumu [a+b]%,[c]%. The first two Tax rates are added and the last Tax rate is then applied on the total.

Example: $100 purchase

$100 x 30% (10%+20%) =$30 for a total of $130.00

$130 x 40% =$52 for a total of $182.00

therefore the total Tax is $82.00

AddCumu [a]%,[b+c]%. The first Tax rates is applied and then the sum of the last two Tax rates is then applied on the total.

Example: $100 purchase

$100 x 10% =$10 for a total of $110.00

$110 x 60% (20%+40%) =$66 for a total of $176.00

therefore the total Tax is $76.00

To enter a Composite Tax Code

button: ![]()

Click the starred line

Type the Tax Code (description), leave the Tax rate as 0. Then in the lower window:

Enter the Tax descriptions and rates for Tax A,B,C.

Set the calculation method. (Do not use Standard)

button: ![]()

button: ![]()